how are 457 withdrawals taxed

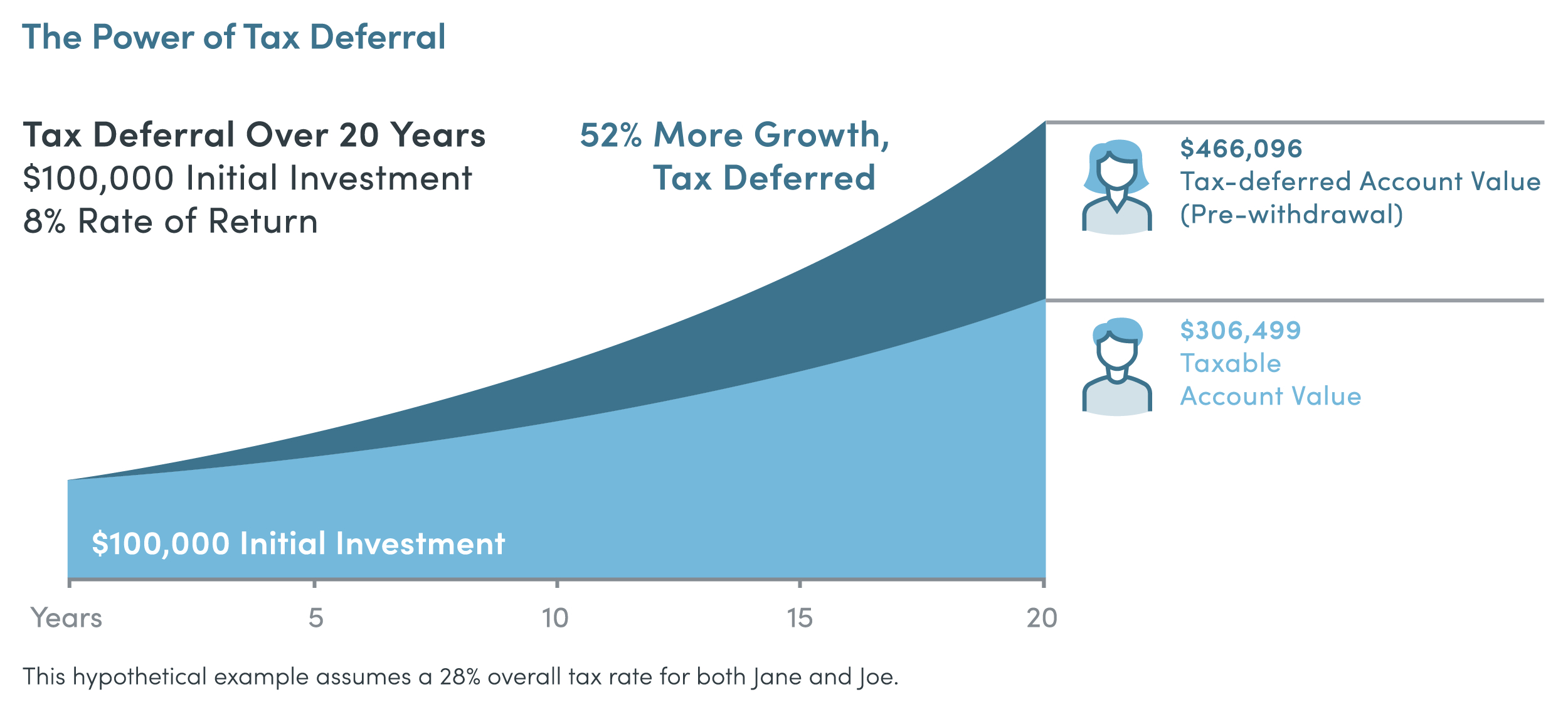

Withdrawals are subject to income tax. Funds are withdrawn from an employees income without being taxed and are only taxed upon withdrawal which is typically at.

The Tax Control Triangle Plan To Rise Above

Withdrawing money from a qualified retirement.

. Use this calculator to see what your net 457 plan withdrawal would be after taxes are taken into account. The amount you wish to withdraw from your qualified retirement plan. Withdrawals are subject to income tax.

How the 457 b plan works. Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money. Unlike other tax-deferred retirement plans such as IRAs or.

The amount you wish to withdraw from your qualified retirement plan. Most 457 plans if not all are considered taxable once you. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501.

When you take out money in retirement you pay income taxes on the withdrawals. A distribution is not included in income and therefore. I received a 1099-R and the boxes had all the information TurboTax needed to know how I needed to be taxed.

So if you need to tap into your 457b contributions before you reach age 595 and youve left the job that provided you with the 457b dont fret. Basically any amount you withdraw from your 401k account has taxes withheld at 20 and if youre under age 59½ youll be taxed an additional 10 when you file your return. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

The IRS will impose a 10 percent penalty on early withdrawals from a traditional IRA or 401 k for example but not a 457 plan from which you can take penalty-free distributions beginning at. You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan.

Employees are taxed on distributions from a 457 retirement plan if the distributions are includible in the participants income. For this calculation we assume that all contributions to the retirement account. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Any attempted rollovers to an IRA of amounts distributed from a 457f plan or a 457b plan maintained by a tax-exempt entity are excess contributions that are subject to IRC. With a Roth 457b you fund your account with money thats already been taxed in exchange. However you will have to pay income taxes on the.

A 457 b is similar to a 401 k in how it allows workers to put away money into a special retirement account that provides tax advantages. 457 Plan Withdrawal Calculator. For this calculation we assume that all contributions to the retirement account.

You are permitted to withdraw money from your 457 plan. You will still however need to. How is 457b taxed.

The only difference is there are no withdraw penalties and that. 457 plans are taxed as income similar to a 401k or 403b when distributions are taken. All distributions from IRAs 401 ks 403 bs and 457 accounts are subject to income taxes at ordinary income tax rates.

A 457 plan is a tax-deferred retirement savings plan.

Make Saving For Your Future Less Taxing Security Benefit

What Are Defined Contribution Retirement Plans Tax Policy Center

Retirement Income Calculator Faq

Vanguard Consider The Advantages Of Roth After Tax Contributions

Should You Pay Off Your Home With Retirement Funds Pros And Cons

Tax Consequences Tsp Withdrawals Rollovers From A Tsp Account Part 1

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

2019 Us Year End Tax Planning Us Tax Financial Services

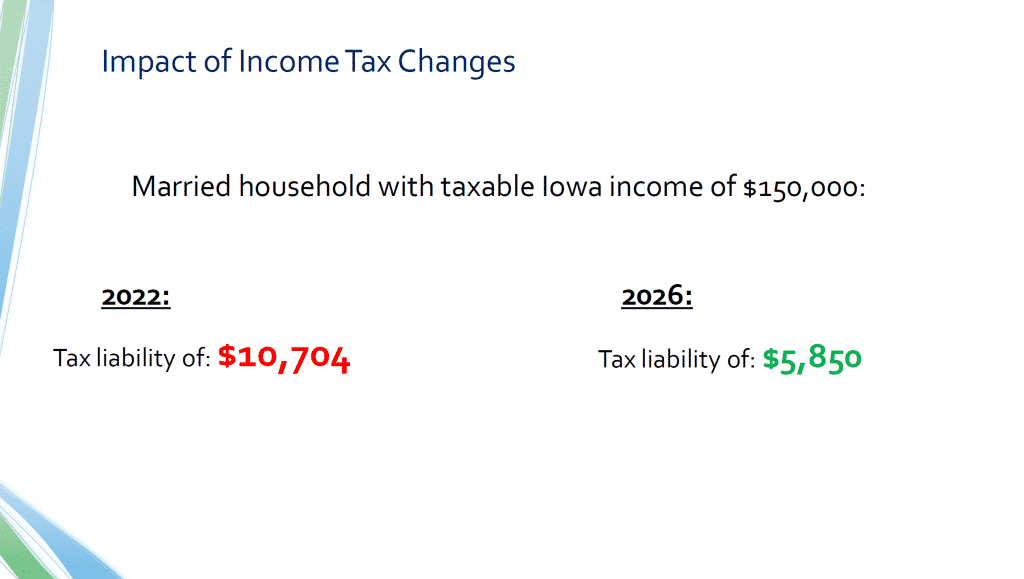

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

The Hierarchy Of Tax Preferenced Savings Vehicles

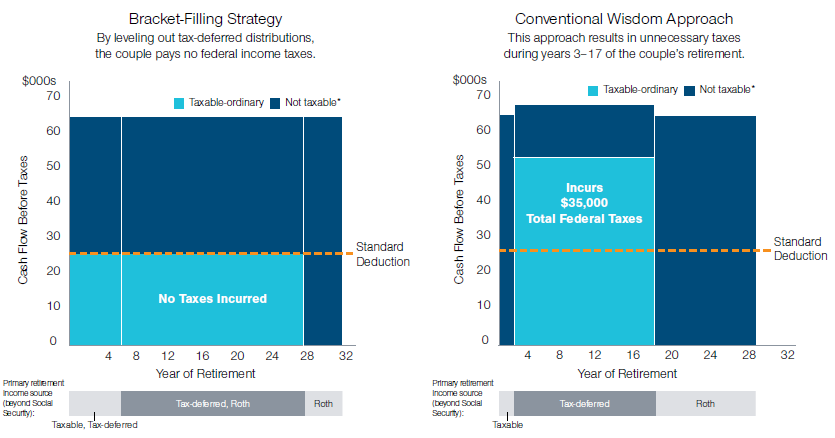

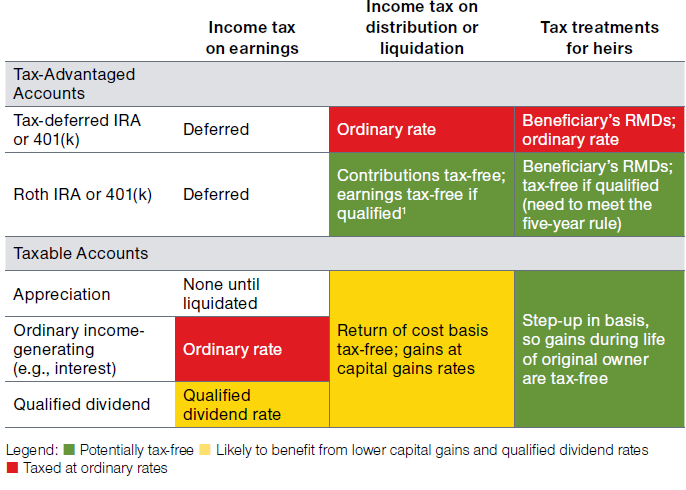

A Tax Savvy Approach To Help Make The Most Of Your Retirement Income T Rowe Price

Income Tax And Capital Gains Rates 2019 03 01 19 Skloff Financial Group

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

How To Make Your Retirement Account Withdrawals Work Best For You T Rowe Price